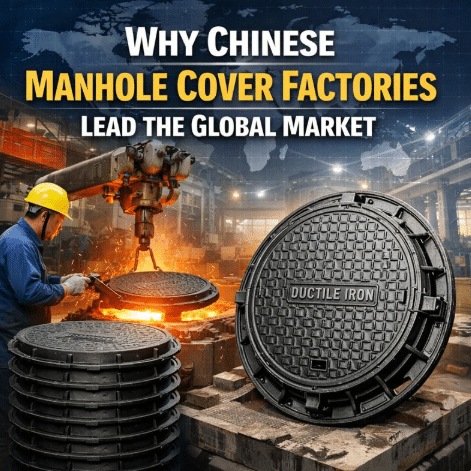

Over the past two decades, Chinese manhole cover factories have emerged as dominant players in the global infrastructure supply chain. From municipal roads in Europe to industrial zones in Southeast Asia and large-scale projects in the Middle East, manhole covers manufactured in China are now widely specified, approved, and installed. This dominance is not accidental, nor is it based solely on low pricing.

Large-Scale Manufacturing Capacity and Industrial Clusters

One of the most decisive factors behind China’s global leadership is its unmatched manufacturing scale. Chinese manhole cover factories are typically concentrated in specialized industrial clusters, where foundries, mold makers, machining workshops, coating facilities, and logistics providers operate in close proximity. This clustering significantly reduces production lead times and coordination costs.

Large-scale capacity enables Chinese factories to handle high-volume municipal tenders and multi-country infrastructure projects simultaneously. Unlike smaller regional manufacturers, they can respond quickly to demand fluctuations, urgent delivery schedules, and customized specifications without compromising output stability. This scalability makes Chinese suppliers especially attractive to international EPC contractors and government buyers managing complex project timelines.

Cost Efficiency Without Sacrificing Core Performance

While price competitiveness is often cited, it is important to understand why Chinese factories can offer lower costs. The advantage is not based on inferior materials, but on economies of scale, automation, and supply chain integration. Raw materials such as ductile iron are sourced domestically at stable prices, while automated molding lines and CNC machining reduce labor-intensive processes.

As a result, Chinese manhole cover factories can deliver products that meet EN124, ASTM, and other international standards at a significantly lower total cost. For global buyers focused on lifecycle value rather than unit price alone, this balance between affordability and performance is a key reason Chinese products continue to gain market share.

Strong Compliance with International Standards and Certifications

Modern Chinese manhole cover manufacturers have made substantial investments in quality management systems and international compliance. Leading factories now routinely operate under ISO 9001, ISO 14001, and ISO 45001 frameworks, and provide third-party test reports for load classes such as A15, B125, C250, D400, and beyond.

This level of compliance reduces procurement risk for overseas buyers. It also reflects a shift from “low-cost manufacturing” to standard-driven industrial production, aligning Chinese factories with the technical and regulatory expectations of Europe, North America, and developed Asian markets. Compliance is no longer optional; it is a core competitive asset.

Advanced Customization and OEM Capabilities

Another critical advantage lies in custom manufacturing and OEM flexibility. Chinese manhole cover factories excel at producing customized sizes, logos, surface patterns, locking systems, and coatings tailored to local standards or branding requirements. This capability is especially valuable for municipalities and utility companies seeking uniform infrastructure identity.

Unlike many manufacturers that focus only on standard catalogs, Chinese factories can adapt molds and production lines efficiently. This flexibility allows buyers to consolidate suppliers across multiple regions, simplifying procurement while maintaining localized compliance and aesthetics.

Integrated Export Logistics and Global Experience

Decades of export-oriented manufacturing have given Chinese factories a deep understanding of international logistics, documentation, and packaging standards. From ISPM 15-compliant pallets to corrosion-resistant packaging for marine transport, export readiness is embedded in standard operating procedures.

Experienced export teams also understand the importance of clear technical documentation, HS codes, certificates of origin, and shipping coordination. This reduces delays, minimizes disputes, and ensures smoother customs clearance—an often-overlooked but decisive factor in global sourcing decisions.

Continuous Innovation and Long-Term Industry Investment

Chinese manhole cover factories are increasingly investing in product innovation, including anti-theft designs, noise-reduction systems, lightweight composite alternatives, and enhanced corrosion-resistant coatings. These innovations are driven not only by domestic demand but also by feedback from global markets.

By reinvesting profits into R&D and equipment upgrades, leading manufacturers maintain long-term competitiveness rather than relying on short-term cost advantages. This strategic outlook ensures that Chinese suppliers remain relevant as infrastructure requirements evolve worldwide.

Conclusion

The global dominance of Chinese manhole cover factories is the result of structural advantages rather than temporary market conditions. Large-scale production, cost efficiency, international compliance, customization capability, export expertise, and continuous innovation collectively position China as the primary sourcing hub for manhole covers worldwide. For international buyers, understanding these factors enables more informed procurement decisions and long-term supply stability.

Frequently Asked Questions (FAQ)

1. Are Chinese manhole covers compliant with EN124 standards?

Yes. Reputable Chinese factories routinely manufacture and test products according to EN124 and ASTM standards.

2. Is lower cost associated with lower quality?

Not necessarily. Cost advantages mainly come from scale, automation, and supply chain efficiency.

3. Can Chinese factories provide custom designs and logos?

Yes. OEM and custom branding are common capabilities.

4. How reliable are Chinese suppliers for long-term projects?

Established factories with export experience are highly reliable for multi-year infrastructure projects.

5. What should buyers verify before choosing a Chinese factory?

Certifications, test reports, export experience, and quality control processes.